The Ultimate Guide to Forex Trading

Forex trading, also known as foreign exchange trading or currency trading, involves buying and selling currencies to profit from changes in exchange rates. This guide will take you through the fundamental concepts, strategies, and tools necessary to navigate the Forex market successfully. For those trading from Uzbekistan, finding the right broker is crucial; you can explore various options at forex trading tutorial Uzbekistan Brokers.

1. Understanding Forex Trading

Forex trading is the act of exchanging one currency for another at an agreed price. Unlike stocks, which are traded on exchanges, the Forex market is decentralized and operates 24 hours a day. This makes it accessible to individuals and institutions worldwide. The major currency pairs traded include EUR/USD, GBP/USD, and USD/JPY, among others.

2. The Basics of Currency Pairs

In Forex trading, currencies are quoted in pairs. The first currency in a pair is the base currency, while the second is the quote currency. For example, in the pair EUR/USD, the euro is the base currency, and the US dollar is the quote currency. The price of a currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding how these pairs work is essential for making informed trading decisions.

3. Types of Forex Orders

There are several types of orders traders can place in the Forex market:

- Market Order: An order to buy or sell a currency pair at the current market price.

- Limit Order: An order to buy or sell a currency pair at a specified price or better.

- Stop Loss Order: An order that automatically closes a trade at a specified price to minimize losses.

- Take Profit Order: An order that automatically closes a trade at a specified price to lock in profits.

4. How to Analyze the Forex Market

Successful Forex trading relies heavily on analysis. There are two primary methods to analyze the market:

- Fundamental Analysis: This method focuses on economic indicators, news events, and geopolitical factors that can affect currency values. Understanding interest rates, employment data, and GDP growth can provide insights into currency movements.

- Technical Analysis: This method involves analyzing historical price charts and using various indicators (such as moving averages, RSI, MACD) to forecast future price movements. Traders often look for patterns and trends in the market to make informed decisions.

5. Risk Management in Forex Trading

Risk management is a critical component of successful trading. Without effective risk management strategies, traders can suffer significant losses. Here are some essential tips for managing risk in Forex trading:

- Use a Trading Plan: A solid trading plan should outline your trading strategy, risk tolerance, and goals.

- Set Stop Loss and Take Profit Levels: Always use stop loss orders to limit potential losses. Take profit orders will help secure your gains.

- Manage Leverage: Leverage can amplify both profits and losses. Use it carefully and understand the risks involved.

- Diversify Your Portfolio: Avoid putting all your capital into one trade. Spread your investments across multiple currency pairs to minimize risk.

6. Choosing the Right Forex Broker

Selecting a reliable Forex broker is one of the most critical decisions a trader will make. Here are some factors to consider when choosing a broker:

- Regulation: Ensure that the broker is regulated by a recognized financial authority to guarantee a level of security.

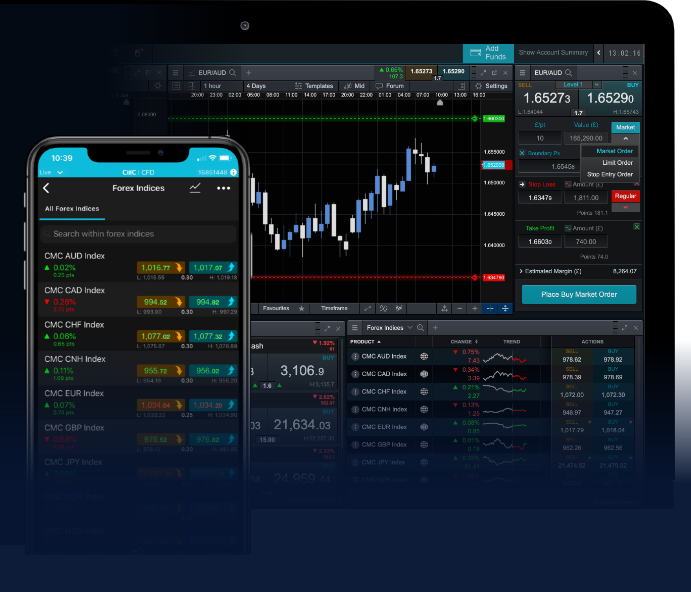

- Trading Platform: The platform should be user-friendly and offer essential tools for analysis and trading.

- Spreads and Commissions: Compare the spreads and fees associated with different brokers to ensure you are getting a good deal.

- Customer Support: Good customer service is crucial for resolving any issues quickly and efficiently.

7. Developing a Trading Strategy

A well-thought-out trading strategy is essential for success in Forex trading. Here are some popular strategies:

- Day Trading: A strategy that involves opening and closing positions within the same trading day to capitalize on short-term price movements.

- Swing Trading: A medium-term strategy that involves holding positions for several days or weeks to take advantage of market swings.

- Scalping: A short-term strategy that aims to make small profits on numerous trades throughout the day.

8. Staying Updated with Forex News

Keeping up with Forex news and market events is vital for making informed trading decisions. Economic calendars can help you track upcoming events, such as central bank meetings, employment reports, and other significant indicators that can impact currency values. Utilize resources such as financial news websites, economic blogs, and market analysis reports to stay informed.

9. Practicing Forex Trading

Before trading with real money, consider practicing on a demo account. Many brokers offer demo accounts that allow you to trade with virtual money. This is a great way to test your strategies, understand the trading platform, and gain confidence before entering the live market.

10. Conclusion

Forex trading can be a lucrative endeavor if approached with the right knowledge, strategies, and risk management practices. Always remember to stay disciplined, continually educate yourself, and adapt to market conditions. By applying the principles outlined in this guide, you’ll be well on your way to mastering Forex trading. Happy trading!