Forex Trading vs. Stocks: Which is Better for You?

When it comes to investing, two popular avenues often come to mind: trading forex vs stocks Trading PH forex and stock trading. Each market presents unique opportunities and challenges, making the decision of where to focus your trading efforts a critical one. In this article, we will explore the differences between forex and stocks, examine the pros and cons of each market, and provide insights to help you make an informed decision based on your trading style and financial goals.

Understanding the Basics

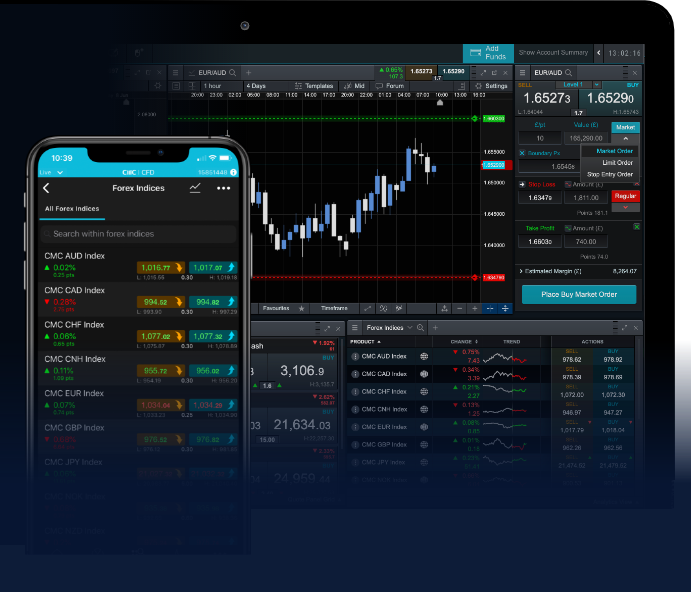

What is Forex Trading?

Forex, or foreign exchange, trading refers to the buying and selling of currencies from around the world. The forex market is known for its enormous size and liquidity, dwarfing the stock market by trading trillions of dollars in currency daily. Forex operates 24 hours a day, five days a week, allowing traders to engage in trading at virtually any time.

What is Stock Trading?

Stock trading involves buying and selling shares of publicly traded companies. When you purchase a stock, you are essentially buying a small piece of the company. The stock market operates on specific hours and is closed during weekends and holidays. Stock prices can be influenced by various factors, including company performance, economic indicators, and market trends.

Market Structure

Forex Market Structure

The forex market is decentralized and operates through a global network of banks, financial institutions, and individual traders. There are no centralized exchanges, meaning that quotes can vary slightly between different brokers. The market is categorized into several major participants, including central banks, multinational corporations, hedge funds, and retail traders.

Stock Market Structure

The stock market, on the other hand, is centralized and operates through exchanges like the New York Stock Exchange (NYSE) and the NASDAQ. Stocks are traded in an organized manner, and prices are determined by supply and demand dynamics within these exchanges. Each stock has a unique ticker symbol and is listed on a specific exchange.

Trading Hours

Forex Trading Hours

One of the key advantages of forex trading is its 24-hour accessibility. With major trading centers located in London, New York, Tokyo, and Sydney, the forex market is always open for business. This allows traders to capitalize on price movements at any time of day, accommodating different lifestyles and schedules.

Stock Trading Hours

In contrast, stock markets have specific trading hours. For example, the NYSE operates from 9:30 AM to 4:00 PM EST on business days. Some brokers offer pre-market and after-hours trading, but trading volumes are lower during these times, which can lead to higher volatility and wider spreads.

Liquidity

Forex Liquidity

The forex market is recognized for its high liquidity. This means that large transactions can occur without causing significant price fluctuations. High liquidity allows traders to enter and exit positions quickly, which is especially important for those who rely on short-term trading strategies.

Stock Liquidity

While the stock market is also relatively liquid, it varies significantly between different stocks. Blue-chip stocks tend to have high liquidity, whereas small-cap stocks may not. Lower liquidity in specific stocks can lead to wider spreads and slippage, impacting trade execution.

Leverage

Forex Leverage

Forex trading often offers higher leverage compared to stock trading. Depending on the broker and jurisdiction, leverage can reach up to 100:1, 200:1, or even higher. This means traders can control significant positions with a small amount of capital. However, high leverage increases the potential for both profits and losses.

Stock Leverage

In the stock market, leverage is typically lower, often around 2:1 for retail investors. Margin accounts allow traders to borrow money to purchase stocks, but the amount is limited compared to forex. This lower leverage can reduce risk but also limits the potential for high returns.

Volatility

Forex Volatility

The forex market can exhibit high volatility due to global economic events, geopolitical tensions, and central bank policies. While volatility can create opportunities for forex traders, it also carries the risk of rapid price changes that can lead to losses.

Stock Volatility

Volatility in the stock market is also influenced by earnings reports, economic data, and market sentiment. Certain sectors may experience higher volatility than others. Generally, stocks can show bursts of volatility around significant news events or market events.

Trading Strategies

Forex Trading Strategies

Forex trading commonly employs strategies such as scalping, day trading, swing trading, and position trading. Traders often rely on technical analysis, chart patterns, and economic indicators to inform their strategies. The ability to trade around the clock allows for a variety of strategies to be implemented based on different market conditions.

Stock Trading Strategies

In stock trading, common strategies include value investing, growth investing, day trading, and options trading. Investors may take a long-term perspective, focusing on a company’s fundamentals, or adopt a short-term approach, relying on technical indicators. Stock traders typically analyze a company’s financial statements, industry performance, and overall market conditions.

Conclusion

Deciding between forex trading and stock trading is dependent on your individual goals, risk tolerance, and trading style. Forex may be more suitable for active traders seeking high liquidity and the ability to trade around the clock. On the other hand, stock trading may appeal to those who prefer a more familiar market structure with opportunities for long-term investment growth. Evaluate your preferences and the market conditions to choose the path that complements your trading strategy and investment goals.