Mastering the Exness Scalping Strategy for Maximum Profit

Scalping has become one of the most popular trading strategies in today’s financial markets, particularly for those looking to maximize their profits within a short period. The Exness scalping strategy is specifically tailored to facilitate this trading style. It allows traders to exploit small price movements in the forex market, making quick profits on trades held for only a few minutes or seconds. For those eager to learn more about effective trading strategies, take a look at this Exness scalping strategy https://career.thelorry.com/2025/05/19/exactly-how-to-purchase-google-goog-shares-3/ that discusses purchasing shares of high-profile companies, which can also provide insights into economic trends.

Understanding Scalping

Scalping is a day trading strategy that involves making dozens of trades in a day, aiming to earn small profits from each trade. This approach requires significant focus and quick decision-making. Scalpers often rely on technical analysis, using charts and indicators to guide their trades, rather than fundamental analysis, which assesses the overall economic conditions that can impact market prices.

The Basics of the Exness Scalping Strategy

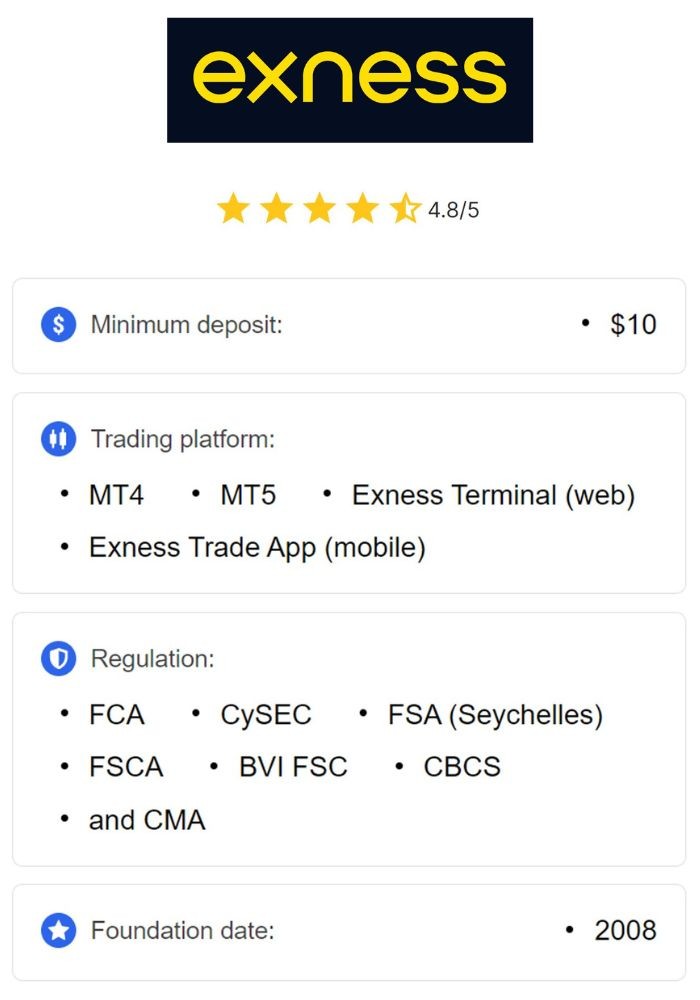

Exness is a trading platform that offers traders a range of tools and resources for effective scalping. The platform provides low spreads and fast execution times, which are essential for scalpers. Here are some key components of an effective scalping strategy using Exness:

- Timeframe: Most scalpers use 1-minute or 5-minute charts to identify quick trading opportunities.

- Indicators: Moving averages (MA), Relative Strength Index (RSI), and Bollinger Bands are commonly used indicators that can help scalpers determine entry and exit points.

- Risk Management: Setting stop-loss orders and adhering to strict risk management practices is crucial to minimize potential losses.

- Market Conditions: Scalpers typically look for volatile market conditions, as price fluctuations provide more opportunities for quick trades.

Setting Up Your Exness Account for Scalping

To start scalping on Exness, you need to set up your account correctly. Ensure you select an account type that offers low spreads and fast execution speeds. Once your account is set up, you can begin to implement your trading strategy:

- Create a demo account to practice scalping without risking real money. This allows you to refine your strategy and become comfortable with the platform.

- Analyze the market to identify currency pairs that exhibit high volatility and liquidity, as these are the best for scalping.

- Use technical analysis tools provided by Exness to identify entry and exit points. Keep an eye on economic news that could impact market conditions.

- When comfortable, transition to a live account, starting with smaller positions and gradually increasing your investments as your confidence and skills grow.

Tools and Indicators for Scalping Success

Utilizing the right tools and indicators can make a significant difference in your scalping success. Here are some to consider:

1. Moving Averages

Moving averages help smooth out price action and identify trends. Scalpers might use short-term moving averages (like the 5-period) alongside longer-term ones (like the 20-period) to find potential crossover points for entry and exit.

2. Bollinger Bands

Bollinger Bands can indicate when an asset is overbought or oversold. Scalpers can look for breakouts above the upper band for sell signals and below the lower band for buy signals.

3. RSI (Relative Strength Index)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, and values over 70 can indicate overbought conditions while values below 30 can indicate oversold conditions, making it useful for identifying potential reversal points.

Risk Management Strategies

Risk management is critical in scalping, where the profit per trade is small, but risks can accumulate quickly. Here are some strategies to manage your risk effectively:

- Set Stop-loss Orders: Establish clear stop-loss levels for every trade to limit potential losses.

- Position Sizing: Avoid risking more than 1-2% of your trading capital on a single trade.

- Keep a Record: Maintain a trading journal to track your trades and identify successful strategies while learning from mistakes.

Final Thoughts on Exness Scalping

The Exness scalping strategy is an excellent way to engage with the financial markets actively. By focusing on quick trades and practicing effective risk management, traders can capitalize on small price movements effectively. Remember that while scalping can be profitable, it requires patience, discipline, and a well-thought-out strategy.

Ultimately, whether you are new to scalping or an experienced trader looking to refine your approach, mastering the Exness scalping strategy can provide a significant edge in today’s fast-paced trading environment. Always practice on a demo account before transitioning to live trading, and stay up to date with market news and trends to enhance your overall trading effectiveness.